CAISO’s EDAM & DAME: What’s Next, Who’s In, and What You Need to Know

ISO Market Edge | Volume 3

As the California Independent System Operator (CAISO) finalizes preparations for one of the most significant wholesale market transformations in a generation, market participants across the Western United States are preparing for EDAM (Extended Day-Ahead Market) and DAME (Day-Ahead Market Enhancements). These initiatives move beyond traditional regional boundaries and into a more coordinated, efficient, and transparent day-ahead market that promises reliability, renewable integration, and cost benefits, but also higher operational complexity and readiness requirements for participants.

Building on the foundational overview from our first ISO Market Edge Newsletter edition, this update provides deeper insight into upcoming milestones, market participants, timelines, participant readiness expectations, and strategic actions.

What Is EDAM — The Big Picture

At its core, the Extended Day-Ahead Market (EDAM) expands CAISO’s existing day-ahead market (DAM) beyond California to include voluntary participating balancing authorities throughout the West. It builds on the success of the Western Energy Imbalance Market (WEIM) by introducing day-ahead scheduling, unit commitment, and optimized congestion management across a broader footprint.

DAME introduces new products and pricing mechanisms (e.g., imbalance reserve and reliability capacity) to provide better flexibility, price signals, and reliability support ahead of real-time operations.

EDAM extends the day-ahead market beyond California to participating balancing authorities, enabling joint day-ahead scheduling and optimization across a broader footprint.

DAME is considered the first necessary step for EDAM. It’s important to understand that DAME affects ALL market participants, not just EIM participants. Together, these initiatives aim to improve regional reliability, reduce costs, and enhance renewable integration across the Western interconnection.

Why It Matters for Market Participants

EDAM represents the first true regional day-ahead electricity market in the Western Interconnection. For participants, this means:

Coordinated day-ahead optimization: balancing demand and supply efficiently across multiple states.

Lower production and transmission costs by economic dispatch of resources over a wider area.

Improved reliability and visibility into regional supply and demand conditions ahead of real-time operations.

Greater transparency and opportunity to use renewables with optimized scheduling and reduced curtailments.

These benefits accrue only if participants fully integrate systems, processes, and staffing into the new market environment, a point often underestimated. We recommend all participants are aware of the DAME changes and participate in parallel operations beginning in February 2026.

Where We Are Now: Market Readiness & Approvals

Both EDAM and DAME were bundled into tariff changes approved by the Federal Energy Regulatory Commission (FERC) in 2023, reflecting the system’s need for a coordinated regional market and more sophisticated day-ahead and reserve products. DAME enhances CAISO’s day-ahead market with new products (e.g., imbalance reserve and reliability capacity) that help manage uncertainty ahead of real-time operations.

Together, EDAM and DAME are designed to:

Improve grid reliability

Reduce costs through better economic dispatch

Enhance renewable and low-carbon integration

Strengthen regional collaboration

Critical Upcoming Milestones

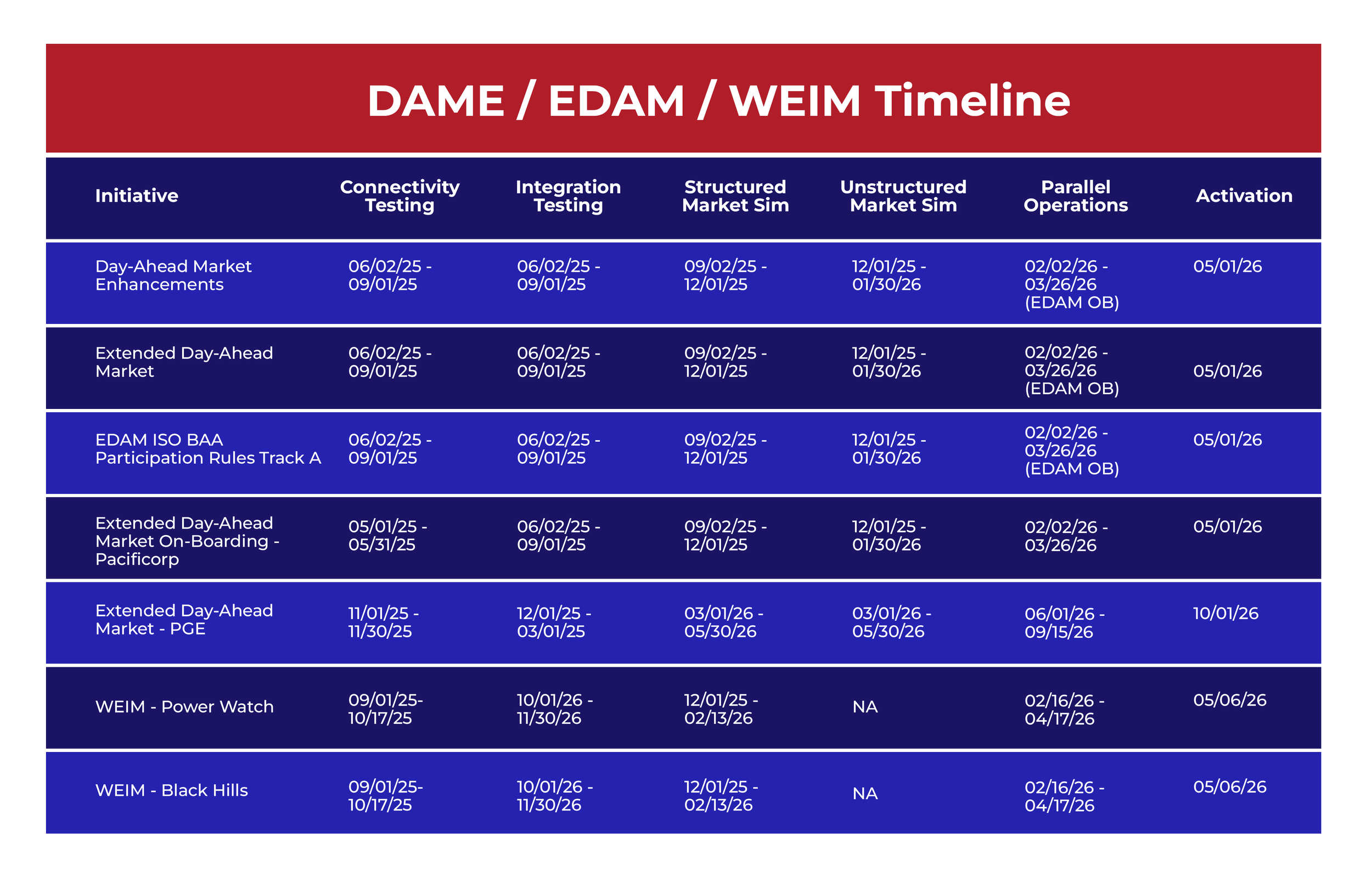

These milestones reflect an 18-month onboarding window with stages like connectivity testing, market simulation, parallel operations, and production readiness checks.

Who’s Participating (Early Adopters & Commitments)

Several market participants are progressing toward EDAM participation:

PacifiCorp: The first adopter, targeting May 2026 go-live.

Portland General Electric (PGE): Targeted for an October 2026 integration wave.

Balancing Authority of Northern California (BANC): Engaged in earlier onboarding.

Los Angeles Department of Water & Power (LADWP): Committed to join in mid-2027.

Other WEIM Entities: Nearly 50% of Western load could eventually be represented.

Participation remains voluntary. Utilities may choose to remain in WEIM only or extend into EDAM when it aligns with their business and policy goals.

What Changes for Market Participants

1. Market Operations & Strategy

EDAM introduces new operational norms:

Submitting day-ahead bids and offers across all loads and resources.

Coordinated optimization that may change congestion and price outcomes.

Exposure to region-wide prices, scarcity signals, and reserve products.

Teams across front office, middle office, and back office must adapt to:

Sophisticated bidding strategies

Increased data volume and analytics

Complex settlements and auditing needs

2. Technical & System Integration

Participants must complete:

Network connectivity and firewall/security setup

Certificates and MAPSTAGE access

Parallel operations testing for settlements and data flows

Systems must support hourly bids, multiple product types, and resource modeling that aligns with EDAM and DAME requirements.

3. Market Simulation Participation

Ongoing simulations (running into early 2026) help participants:

Rehearse bid/offer submissions

Validate settlement and reporting workflows

Test DAME product bidding strategies

These exercises reduce operational risk and build confidence ahead of go-live.

Participant Preparation Tips

Operational Readiness

Ensure systems support EDAM bid formats and day ahead schedules.

Update settlements and pricing workflows for new codes and products.

Systems Integration

Confirm firewall connectivity and certificate installation.

Validate access provisioning for all participant users.

Testing & Simulation

Participate actively in CAISO’s simulation windows.

Run internal “day-in-the-life” market drills to catch gaps early.

Hartigen’s Role in Your Readiness

Hartigen is enhancing PowerOptix® to help clients prepare efficiently for EDAM & DAME. Enhancements include support for DAME’s new products, updated bid and offer strategy processes, expanded integration with CAISO reports, and major settlement logic updates to accommodate the new day-ahead structure.

In addition to preparing for the upcoming market changes, Hartigen is partnering with clients to implement custom settlement allocations that enable accurate downstream billing processes. These capabilities help organizations prepare early, reduce manual effort, and operate confidently as CAISO transitions to a more integrated Western market.

Specific optimizations include:

Support for new DAME products and day-ahead bidding logic

Expanded integration with CAISO reporting and settlement feeds

Updated settlement logic aligned with the multi-state market

Custom settlement allocations for accurate billing and financial workflows

These enhancements reduce manual effort, improve accuracy, and enable confidence as you transition into the regional market.

Final Thoughts:

A Transformative Shift

EDAM and DAME are not just another market update; they represent a structural transformation in how electricity is traded and coordinated across the Western U.S.

Participants who embrace early readiness, in systems, staffing, analytics, and strategy, will be better equipped to navigate complexity, manage risk, and capture value under the new EDAM framework.

Your market is expanding and your readiness now determines your results in 2026 and beyond.

References

Content in this edition reflects Hartigen’s internal expertise, with significant contributions from our CAISO market expert, Debra Andrews.